At Forum, we call our portfolios “Global Neutral.” What does that actually mean for investors?

Individual investors have a strong preference for investing in companies based in the country where they live. Behavioral research suggests that familiarity makes stocks from our home country seem less risky. Financial professionals refer to this preference as home bias. Whatever the reason for home bias, we want to move beyond it in our investments.

For those of us who live in the US, investing only in the US would mean giving up a significant amount of the available diversification. Investing in a global neutral way is the opposite of investing with home bias. It’s an investor acknowledging that neither they nor anyone else can predict whether international stocks or US stocks are going to perform better in the future, so it’s better to hold it all. To size the exposure, the investor defers to the market and uses the weighting that exists in the market to each country and region.

This doesn’t imply a bet on international stocks. Rather, it’s about matching the investment opportunity set. If roughly 60% of the global equity market is based in the US, and 40% outside of it, a Global Neutral portfolio will reflect that. It’s not a forecast — it’s discipline.

Why It Matters for Long-Term Investors

A globally neutral portfolio offers broader diversification, which can be a stabilizing force during periods of regional volatility. For example, when US markets experience downturns, other regions may perform better, softening the overall impact on your portfolio. This approach avoids the trap of chasing past performance — a behavior that often leads investors to buy high and sell low.

Moreover, while the US has dominated returns in the past decade, that hasn’t always been the case. In the first 10 years of the 2000s, international stocks significantly outperformed US markets.1 By maintaining global neutrality, we don’t need to guess when these cycles will turn. Instead, we stay consistently invested in the entire opportunity set.

Over the long term, adding to a portfolio any investment that is not highly correlated with its other investments provides an opportunity to reduce risk while maintaining return, and the different regions and countries of the world may not be highly correlated to US investments. By diversifying globally, investors can improve the risk/reward profile of a US-based portfolio.

How Forum Implements Global Neutral

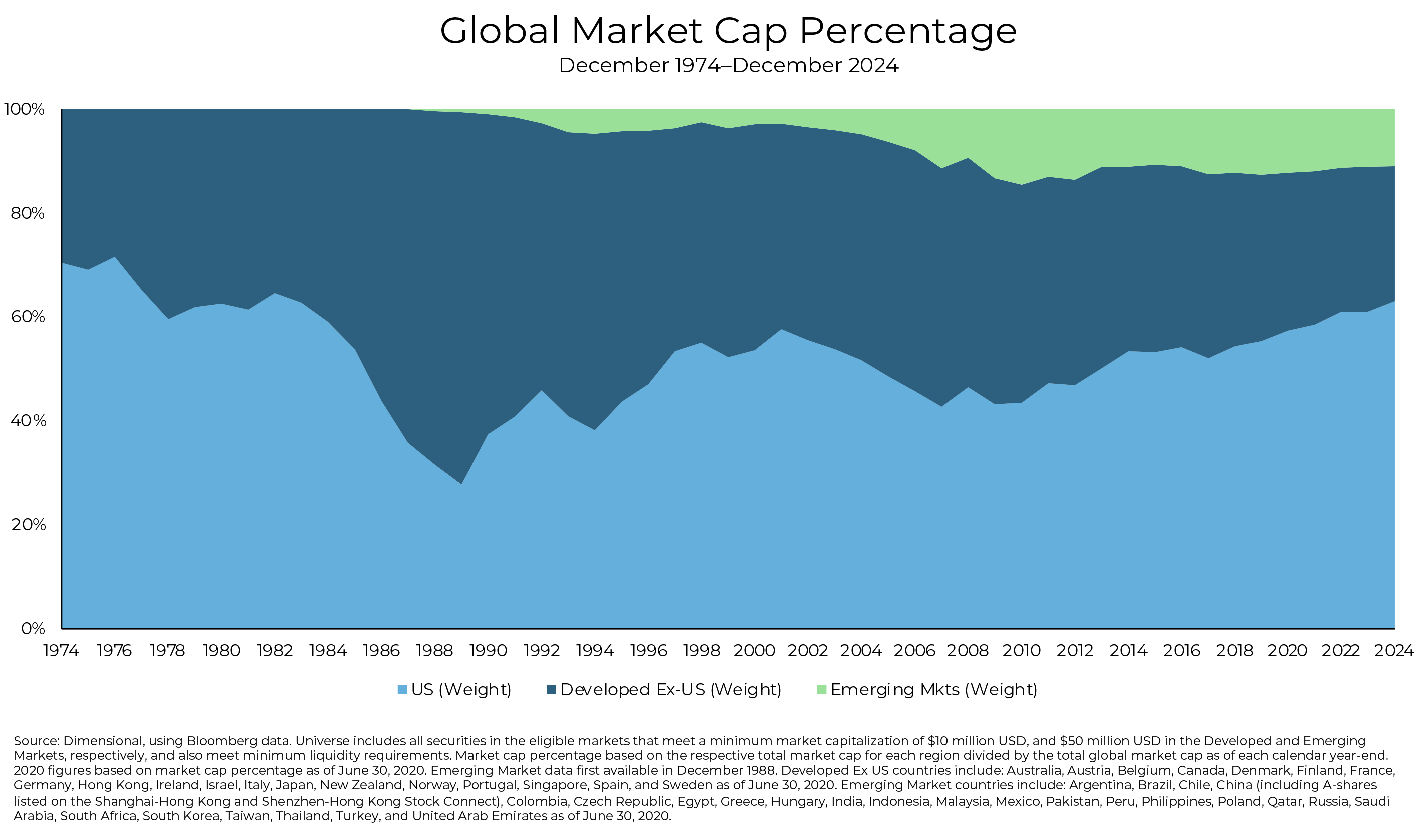

At Forum, our Global Neutral portfolios are constructed based on market capitalization data, which allows us to represent countries and regions proportionately. We don’t tilt heavily toward or away from any one market based on short-term economic data or headlines. As we see in the graph below, the weightings change a lot over time. For example, US weightings have been as high as 70% in the 1970s and as low as 28% in 1989.

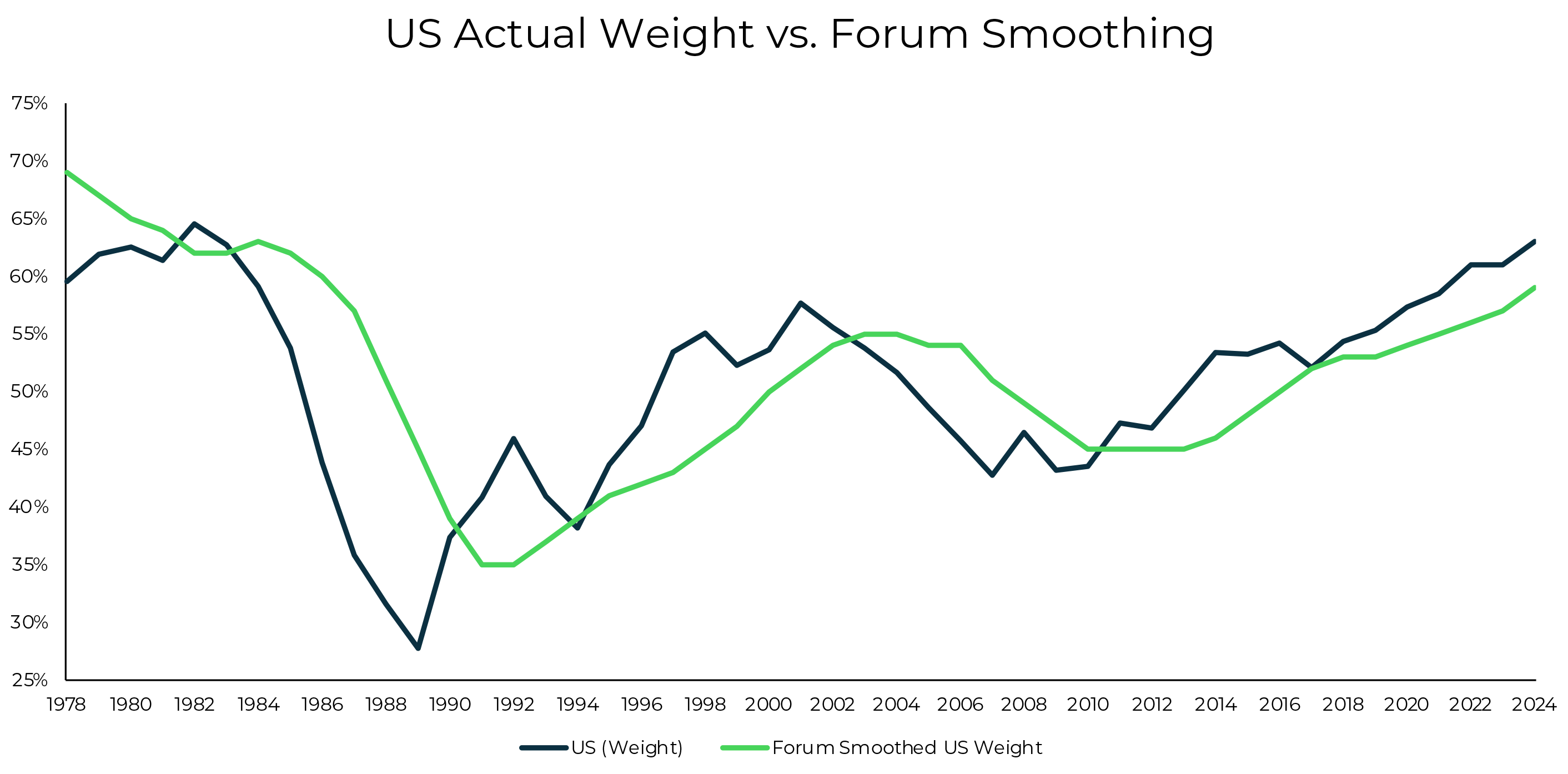

To avoid extreme moves, Forum smooths the weighting over the most recent 5 years, creating a more stable path to remaining global neutral. Below is a graph of what the hypothetical weighting of the US would have been over time using Forum’s 5-Year smoothed weighting.

As we can see, the smoothed approach remains close to the weightings of the markets, while creating a slightly more stable allocation globally.

We also believe this discipline helps reduce emotional decision-making. When the news cycle focuses on geopolitical tensions, recessions abroad, or currency moves, our clients can take comfort in knowing that no single region dominates their portfolio. It’s a structured way to stay invested and focused on what really matters — long-term progress toward your financial goals.

We focus on tax efficiency, rebalancing discipline, and aligning the investment mix with your financial goals. When it comes to geography, we stay neutral because we believe that’s the most rational starting point.

The Bottom Line

Global Neutral is more than just a label — it’s a philosophy rooted in humility, evidence, and discipline. At Forum, we believe it’s the most reliable way to ensure that your portfolio reflects the world as it is, not as we guess it might be. By embracing a global perspective, you’re positioning yourself for long-term success in an unpredictable world.

If you’d like to better understand how this approach fits your financial plan, reach out to your Forum advisor. We’re always here to help guide you with clarity and confidence.

SOURCE

1 Dimensional Global Equity Index Strategy — January 2000–December 2009, Dimensional for Dimensional Index data.

This communication is for informational and educational purposes only and does not constitute investment advice or a recommendation. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio, nor does diversification protect against market risk. All investment strategies have the potential for profit or loss. Historical performance results for investment indexes and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.

The Dimensional Indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Past performance including hypothetical performance is not a guarantee of future results. Actual returns may be lower.