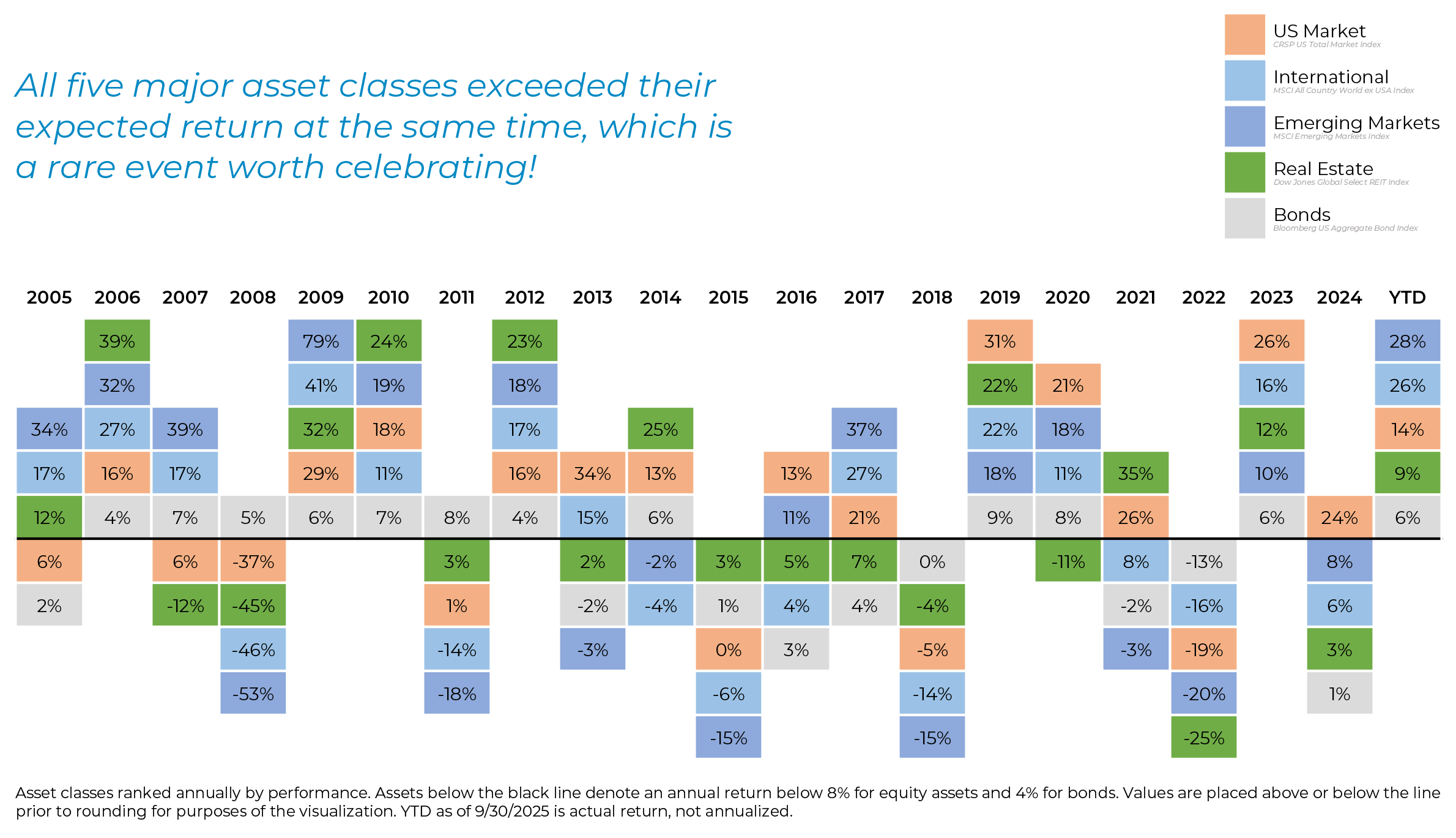

This has been a great year for globally diversified investors so far! Through the end of the third quarter, every major asset class is showing not only positive returns, but above expected returns — US equities, international markets, emerging markets, real estate (REITs), and bonds. That kind of synchronized strength is rare. The benefit of diversification usually means that some asset classes perform better than expected and others perform below expectations, driving a smoother ride overall.

For long-term investors, this is an important moment to pause, reflect, and recognize both the opportunity and the discipline required to capture it.

Why It’s Rare for Everything to Be Positive

Markets rarely move in lockstep. Over the last two decades, it has been far more common for one or more asset classes to finish below expectations in a given year. 2025 stands out because all the “engines” are firing at once. The result: investors who stayed diversified have been rewarded not just by one or two markets, but by nearly all of them.

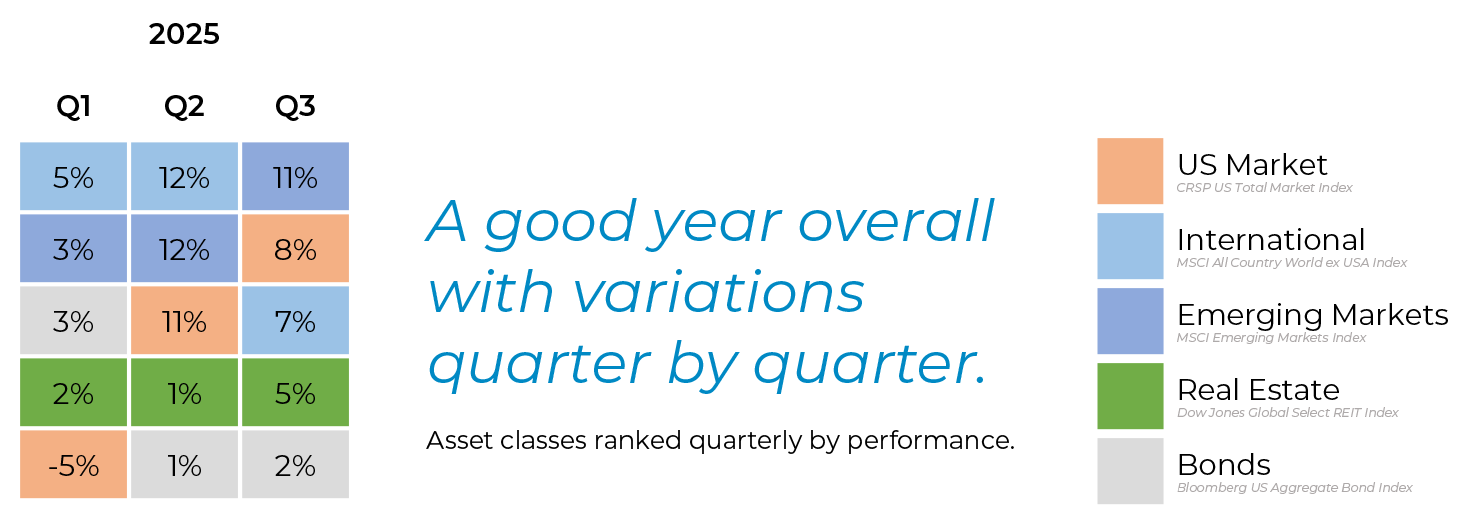

Leadership Rotated Throughout the Year

It is tempting to look at the positive YTD numbers and assume it was a smooth, uniform climb. But the path to today’s outcome was anything but straight.

Q1 | During the first quarter, US equities tumbled down 4.82% for the quarter, while International stocks were up 5.23% with everything else in between. As we noted in the previous quarterly commentary, the prevailing consensus entering 2025 suggested another period of US market dominance. That’s not what happened out of the gates, which highlights the risks of trying to predict markets rather than staying diversified.

Q2 | In the second quarter, equity markets across the globe started the quarter with a very large drop following “Liberation Day” in April when new tariffs were announced. Most asset classes recovered quickly. US stocks, International stocks, and Emerging Market stocks all surged 11%–12% during the quarter. The exception was Treasury bonds, which declined in value as interest rates rose.

Q3 | The third quarter continued the upward trajectory from all equity asset classes with REITs and Bonds contributing with positive returns as well.

Overall, the year has been strongly positive across asset classes. However, the sequence of returns was uneven. Different asset classes took turns leading, and that rotation is what made rebalancing so powerful.

This quilt makes clear that leadership changes hands. No single asset class dominated the entire year. Instead, investors needed to be both diversified and disciplined to benefit across the shifting landscape.

The Value of Rebalancing

When everything ends the year positive, it’s easy to forget how uncomfortable parts of that journey felt. Rebalancing during the year required discipline: trimming back the strong performers (International Equities early on) and adding to laggards (US stocks in the first quarter and around Liberation Day, bonds and REITs mid-year) often felt counterintuitive.

Yet those actions positioned portfolios to capture the later-year rotation. By the time bonds and REITs rallied, disciplined investors had incrementally increased their exposure at attractive entry points.

Without rebalancing, a portfolio could easily have been overweight with the early winners and underexposed to the later ones — reducing the benefit of this year’s broad rally.

Lessons for Investors

Diversification still pays. This year has been a live case study in why diversified portfolios improve your chance of success. No one could have predicted the exact sequencing of returns, but broad exposure ensured investors captured the upside as asset class leadership rotated. While rebalancing is often described as a way to manage risk, in years like this it also adds return. By selling recent leaders (“Selling High”) and buying back into recent underperformers (“Buying Low”), portfolios were better positioned for the future. Although we ought to celebrate when we experience an “all positive” year, we must also recognize it won’t last forever. Valuations are higher, risks remain, and volatility will return at some point. Staying disciplined is as important now as it was when markets were more turbulent.

Looking Ahead

This year has given us a gift: broad gains across nearly all asset classes. But the real lesson isn’t just in the results — it’s in the process. Diversification, discipline, and rebalancing worked, not by predicting the future, but by being prepared for a range of possible outcomes.

That is how we preserve and grow wealth over our lifetime.

Past performance is not a guarantee of future results. Investing involves risk, including the potential loss of principal. Diversification and rebalancing strategies do not ensure a profit or protect against loss. The information provided reflects general market data and does not represent the performance of any Forum Financial Management, LP strategy or client account.

Forum Financial Management, LP (“Forum”) is registered as an investment adviser with the U.S. Securities and Exchange Commission. The firm’s home office is located at 1900 South Highland Avenue, Suite 100, Lombard, IL 60148. Before making any investment decision, please contact our office at (630) 873-8520 to request a copy of Forum’s Investment Advisory Agreement and Form ADV Part 2A, which includes the firm’s fee schedule. For additional information, visit our website at www.forumfinancial.com