Last week, Forum’s Market Commentary addressed the jarring start of the 2025 trade war, as President Donald Trump’s tariff announcements sent markets bouncing. News of the sudden tariffs, countermeasures, and surprise 90-day pause for most countries arrived often without any forewarning, driving markets to respond in unpredictable ways. In this commentary, we zoom out to offer perspective, context, and guidance to help investors navigate the uncertainty.

We will look at:

- What is going on in the world around us

- Why staying invested remains our best advice

- How your portfolio reacts to events

What’s Going On

The greatest near-term risk of the initial salvo of President Trump’s tariffs was that the global economic system might seize up. The 90-day pause on tariffs for most countries announced April 9 relieved a lot of that pressure, as evidenced by markets being up 9.5% for the US S&P 500 and 8.8% for the MSCI All Country World Index (ACWI) in a single day.1

Since that 90-day pause, the focus has been on China and the US escalation of tariffs and counter-tariffs. In addition, this escalation has led both countries to try to persuade trading partners to choose a side. China aims to maintain its manufacturing dominance and expand use of the yuan in worldwide trade. The US wants to stymie any further use of the yuan, reduce China’s dominance of global trade, and shift some manufacturing to either the US or more friendly trading partners.

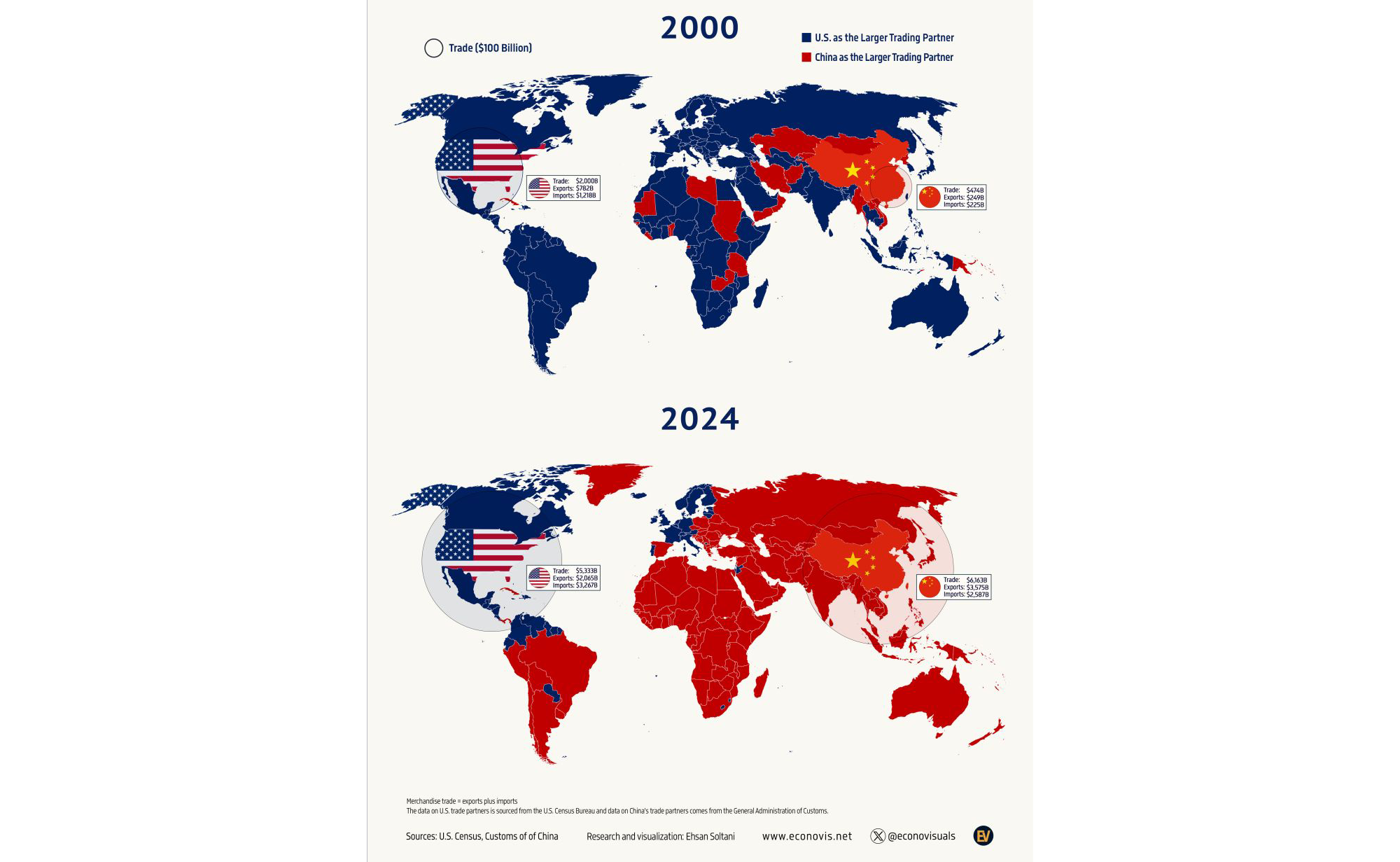

The best illustration of why China is the primary target of the current administration’s trade war is captured in this visualization from www.econovis.net:

While US trade has grown 2.6 times over 25 years, China’s combined trade has gone up 13 times. China is now the largest bi-directional trading partner for the majority of the world — leveraging trade dominance into influence.

Our goal with this article is not to provide a political viewpoint, but rather to help you understand what’s happening so you can make informed investment and life decisions. (Hint: it usually makes sense to stay invested.)

Should I Stay Invested?

We all have opinions about what the future holds. But since none of us have a time-traveling DeLorean with which we could accurately predict what will happen in the future, you’re better off staying invested.

To understand why, we will start by exploring the concept that markets do an excellent job of rapidly adjusting to new information and incorporating the expectations of millions of buyers and sellers into stock prices — in real time.

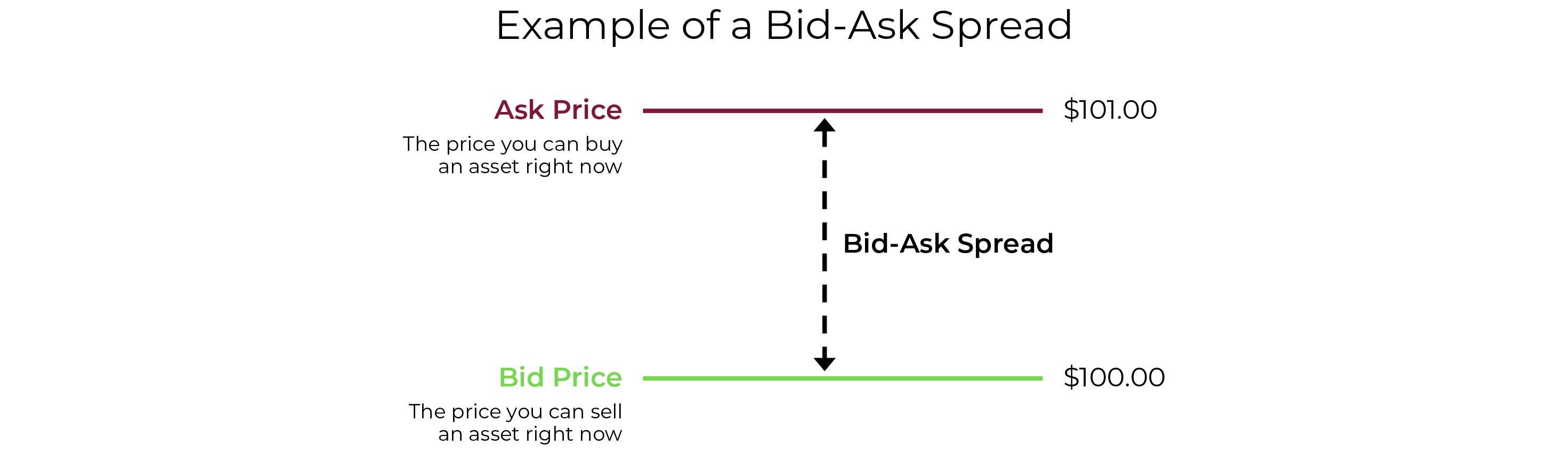

This phenomenon is illustrated by something called the bid-ask spread. After each trade, there’s a brief moment of balance — no one is willing to sell for less than the current bid or buy for more than the current ask. That balance helps stabilize prices until the next trade.

That doesn’t mean the market price is right — just that no one’s willing to trade outside that bid-ask range at that moment. And it doesn’t matter if you are a retail investor or a sophisticated institutional investor, the bid-ask spread is the same.

The market price is a balance of everyone’s best guess about fair price happening in real time, every second. This price movement can happen fast, like after the initial tariff announcement and again when the 90-day tariff delay was announced.

When news is first announced, prices adjust quickly and then stay a bit bumpy as further details filter out. This repricing happens so fast that if you’re reading about it in an article or watching talking heads on the news, then it is probably too late! The best assumption from that point forward is that new information is already baked into the price you’re going to pay.

In the context of the current tariffs: if trade deals are struck between countries, stock prices may rise further. If the US-China trade war expands or other countries are not quick to strike deals, stock prices may go back down.

The current market price is basically a blended guess — an average of what millions of investors think might happen. Beating that collective brainpower isn’t impossible — but it’s extremely rare.

What Does This Mean for My Investments?

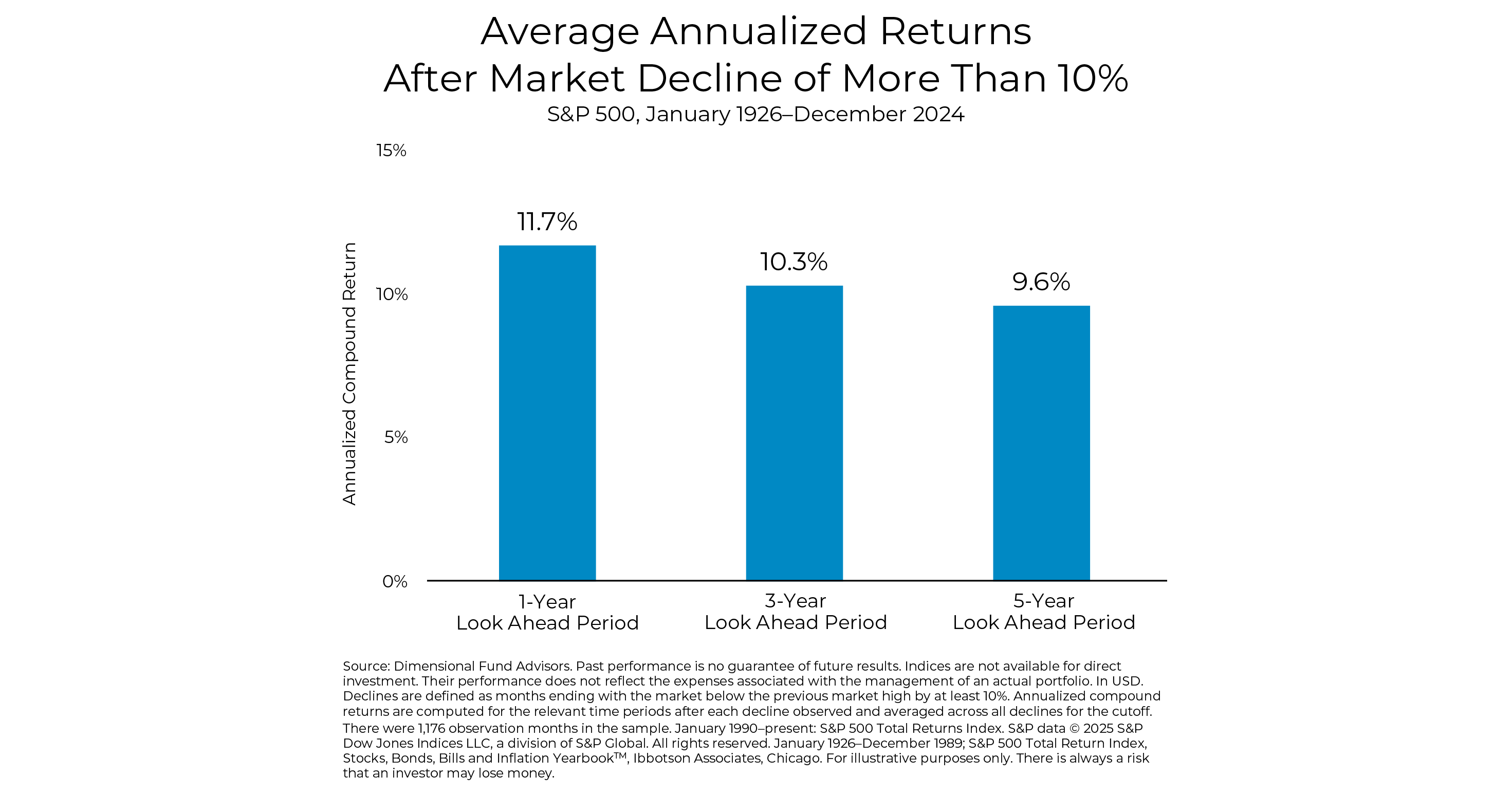

The chart below shows that historical returns after a 10%-or-worse decline have been higher than average for the year ahead. This may seem counterintuitive. It is also the origin of the rule of thumb that “the best time to invest is when things look their worst.” While not always accurate — as things could always get worse — the more likely thing is that at some point they will get better, markets will recover, and that recovery is often rapid.

Looking back, the right thing to do has always been to stay invested although it may not feel like the right thing at the time. All too often, those that get out of the market often end up sitting out too long because markets usually recover faster than the economy or other visible indicators. So, our advice remains to keep your focus on the long-term goal rather than short-term events.

Many people have heightened concern right now about US companies or the US dollar depreciating, or both. This was a concept we wrote about in our recent post, How Far Can It Go? An Examination of US Large Cap Stocks, the emphasis there being to stay diversified globally and to keep holding international stocks even though US stocks — in particular large and growth stocks — had done so much better in recent years.

As pointed out in our April 7 blog post, Forum’s Market Commentary on Tariffs, owning international stocks is crucial to reducing these risks. We control these risks by diversifying, instead of making concentrated bets on what will do better next. At Forum, a little less than half of most clients’ stock allocations are invested in international companies with foreign currency exposure using exchange-traded funds and mutual funds not hedged to the US dollar. Owning both US and international stocks helps cushion returns when the US dollar loses value, compared to owning only US stocks.

Putting It All Together

As the tariff situation continues to unfold, and as political and economic variables shift in real time, our approach remains consistent: acknowledge what we don’t know, build around what we do, and stay grounded in strategies that work over the long term. The market may remain bouncy, and headlines may keep coming. But in the meantime, life goes on, plans evolve, and thoughtful investing continues to reward those who stay focused on what truly matters.

SOURCE

1 As proxied by the ETF daily price change of the S&P 500 (https://finance.yahoo.com/quote/%5EGSPC/history/) and iShares MSCI ACWI ETF (https://finance.yahoo.com/quote/ACWI/history/) respectively.

By clicking on a third-party link, you will leave the Forum website. Forum is linking to this third-party site to share information in a different format and is for informational purposes only. However, Forum cannot attest to the accuracy of information provided by this site or any other linked site. Forum does not endorse the site sponsors or the information or products presented there. Privacy and security policies may differ from those practiced by Forum.