The first half of 2025 served as a reminder of why diversification remains one of the most valuable principles in investing. It was a period marked by volatility, uncertainty, and shifting narratives. Yet, despite the ups and downs, investors with well-diversified portfolios emerged in a stronger position by the end of the quarter compared with investors who lack proper diversification.

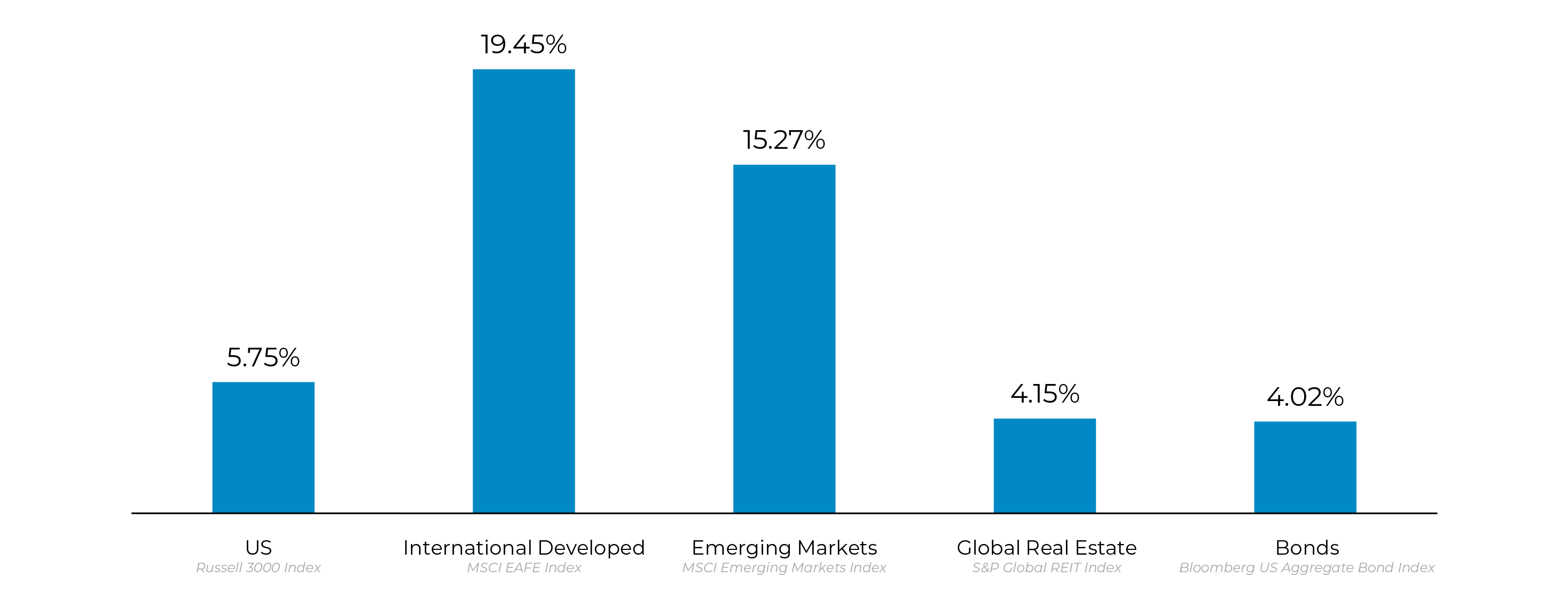

Here are the first half of 2025 results for the major asset classes:

The prevailing consensus entering 2025 suggested another period of US market dominance, driven by the theme of deregulation driving animal spirits and a continuation of American exceptionalism expected to favor US stocks. That’s not what happened, as the chart above shows. Instead, in a surprise to many, international stocks (International Developed + Emerging Markets) outperformed US Stocks by almost 13%!1

Markets Will Always Surprise Us

If there’s one lesson that investors must relearn constantly, it’s that markets don’t follow a predictable path. This underscores the dangers of making investment decisions based on short-term narratives and trying to time markets. Those who concentrated their portfolios exclusively in US equities may have found themselves missing the boat on a strong quarter overall. Investors who pulled out of the market after “Liberation Day” missed out on a strong recovery from mid-April through June.

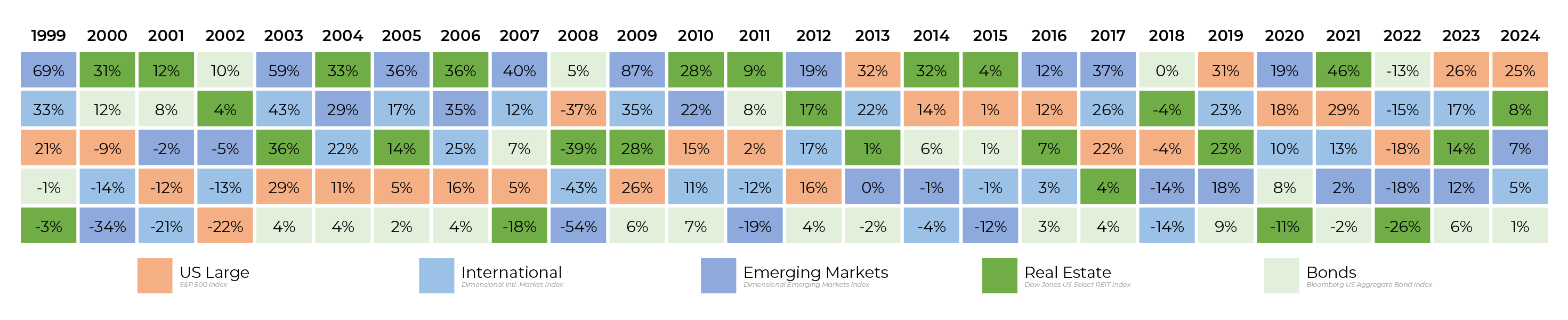

History is full of examples where consensus expectations have been overturned. In 2000, during the height of the dot-com boom, few would have predicted that emerging markets would lead the following decade. Similarly, in 2008, during the depths of the financial crisis, many believed US stocks would take years to recover — yet they went on to deliver a remarkable bull run beginning in March 2009.

This is why even valuation metrics like price-to-earnings (P/E) ratios, while useful for long-term assessment, offer little predictive power in the short run. Consider the quote usually attributed to John Maynard Keynes, “The market can stay irrational longer than you can stay solvent.”

Global Asset Class Returns Since 1999

The Importance of Diversification and Discipline

The unpredictable nature of markets is exactly why diversification and discipline matter so much. A well-diversified portfolio ensures that investors are not overly reliant on a single region, asset class, or sector.

The outperformance of international developed markets to start this year is a textbook example of why global diversification is crucial. The well-known description of diversification as “the only free lunch in investing” is usually attributed to Harry Markowitz, the father of Modern Portfolio Theory. By diversifying investments across various markets and asset classes, investors can reduce risk without necessarily sacrificing returns — a rare advantage in the world of investing.

However, diversification alone isn’t enough. Investors also need the discipline to stay invested through market turbulence. Timing the market — based on short-term movements — is a notoriously difficult, if not impossible, game. As Peter Lynch once said, “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

Turning Volatility Into Opportunity

Rather than fearing volatility, savvy investors use it to their advantage. One of the best ways to do this is through rebalancing — systematically adjusting a portfolio to maintain its target allocations.

Market fluctuations cause asset weights to shift. When stocks rally, they end up comprising a larger portion of a portfolio. When stocks decline, their weighting shrinks. Rebalancing ensures that investors take profits from outperforming assets and reinvest in underperforming areas — essentially, buying low and selling high.

For instance, investors who rebalanced in a disciplined way over the last few years have likely reduced US equity exposure created by its strong performance and reallocated those funds toward international markets when they were relatively undervalued. This year, that discipline has paid off.

The Best Path Forward

2025 has reinforced a timeless truth — market movements are impossible to predict, but our behavior as investors is fully within our own control. The best outcomes come from following a disciplined process — one that embraces diversification, rebalancing, and a long-term perspective.

Investors who stayed the course and maintained globally diversified portfolios were rewarded. Those who tried to outguess the market or chase upward trends likely missed out on this opportunity.

While no one can predict what the next month, quarter, or year will bring, one thing remains certain: investors who focus on process over prediction, discipline over speculation, and diversification over concentration will always be in the best position for long-term success.

SOURCE

1 MSCI ACWI ex-US – Russell 3000 = 12.57% as of June 30, 2025.

By clicking on a third-party link, you will leave the Forum website. Forum is linking to this third-party site to share information in a different format and is for informational purposes only. However, Forum cannot attest to the accuracy of information provided by this site or any other linked site. Forum does not endorse the site sponsors or the information or products presented there. Privacy and security policies may differ from those practiced by Forum.

This communication is for informational and educational purposes only and does not constitute investment advice or a recommendation. Past performance is not indicative of future results. Indices are not available for direct investment; their performance does not reflect the expenses associated with the management of an actual portfolio.