Stock markets have reacted negatively to President Donald Trump’s tariff announcement last week. While sizable tariffs were expected, the scale and structure of the tariffs are what surprised markets.

Let’s Start With an Explanation of Tariffs

Tariffs have not been in the news for a long time, so let’s start with what a tariff is: it is a tax placed on foreign goods. The importer pays the tax. However, the importer will often increase their prices as a result. This higher price generally gets paid by the consumer. Tariffs decrease aggregate demand because some consumers will choose not to buy the goods at higher prices.

The government receives the tax from the tariff. The consumer either consumes less and/or pays a higher price for their consumption. It may or may not result in domestic production increasing, depending on circumstances.

The way tariffs were structured in this case was also highly unusual, using a formula that more approximates the trade deficit with the exporting country than reciprocity of foreign tariffs. This indicates the main goal of these announcements is to negotiate to reduce trade deficits rather than a narrower focus on tariffs specifically.

So, where do things go from here? A lot depends on future events. If negotiations are announced, the downturn could recover quickly, like it did in March 2020 at the height of COVID pandemic lockdowns, or reciprocal tariffs could proliferate, leading to prolonged down markets, like during the oil embargoes of the 1970s. The good news is that many countries are coming to the table to negotiate, and if enough countries do so, then the more confrontational ones may reconsider their stance.

Regardless of the outcome, the most important thing to do during events like this is to remain disciplined. To paraphrase Warren Buffett, we should stick with the plan and rebalance, even — or especially — when others are fearful.

Uncertainty Is Always Uncomfortable

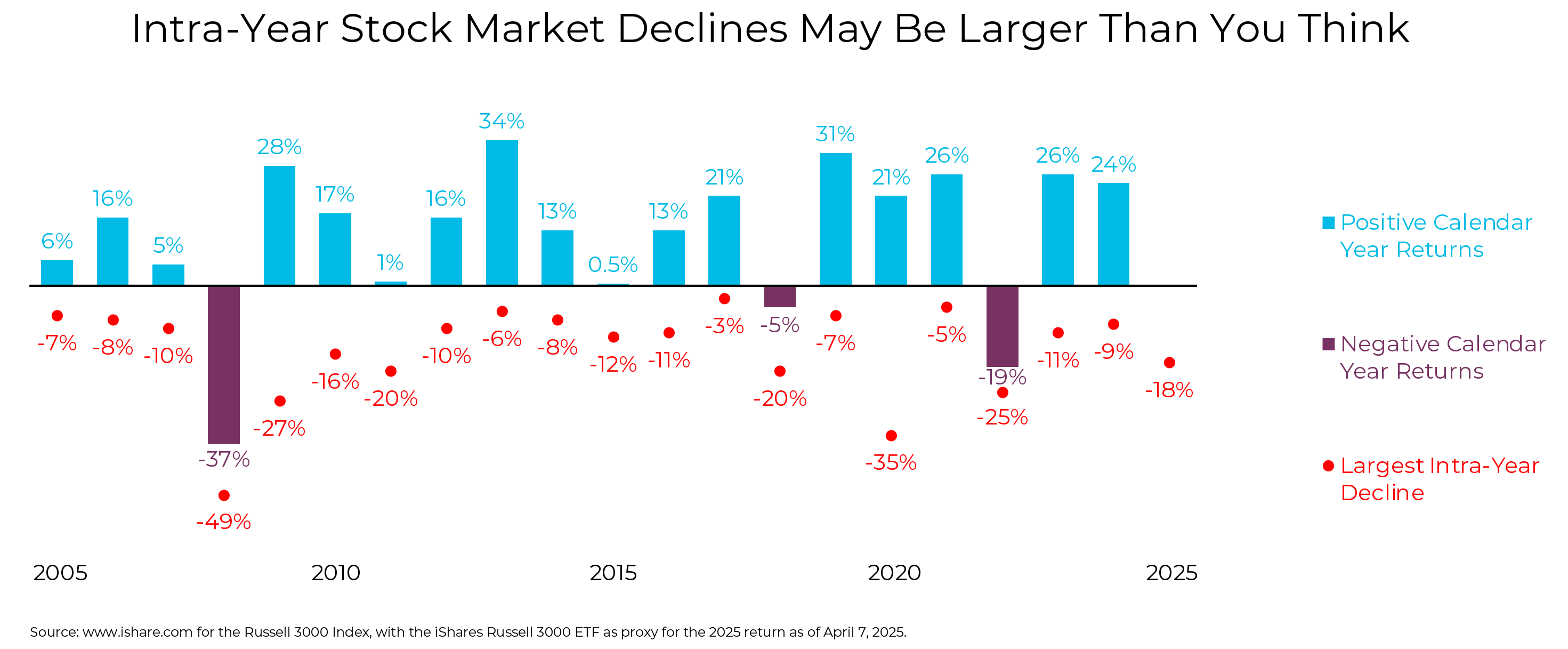

Looking back, investors have had to experience periods like this many times over the years. The following chart provides a bit of context, showing the size of market downturns during any given year (“largest intra-year decline”) and how often markets overcome from these declines to end the year at a gain.

The stock market pulls back at some point every year. Yet, investors are rewarded far more often than not for sticking it out and staying invested. In 17 of the last 20 years, US stocks ended with gains for the year despite 12 of those years experiencing double-digit intra-year declines.

What Do We Do About All of This?

What happens in Washington, D.C., is beyond our control. What we do with portfolios and how we respond to global events are within our control.

At Forum, we remain disciplined. We will look for opportunities to harvest losses for tax purposes and to rebalance long-term portfolios back toward their target stock/bond mix. We are monitoring daily to determine when to trade for each household’s accounts based on how far out of balance they become. That is consistently the best way to weather the storm.

Of note, two of the factors we have advocated for in the past decade have helped our portfolios:

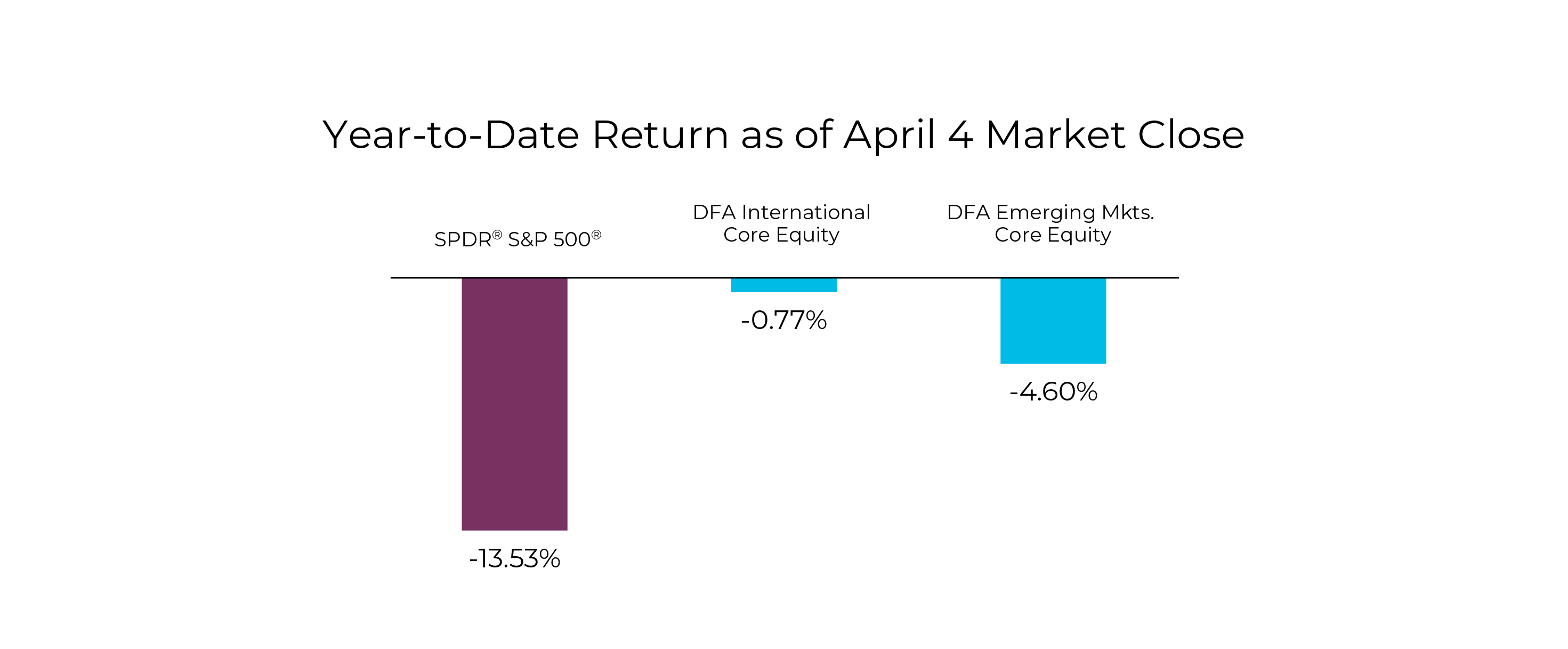

- International Stocks

Some of the worst returns have been among US Large company stocks, which had high prices coming into this downturn. Staying globally diversified with our international stock exposure has helped our portfolios.

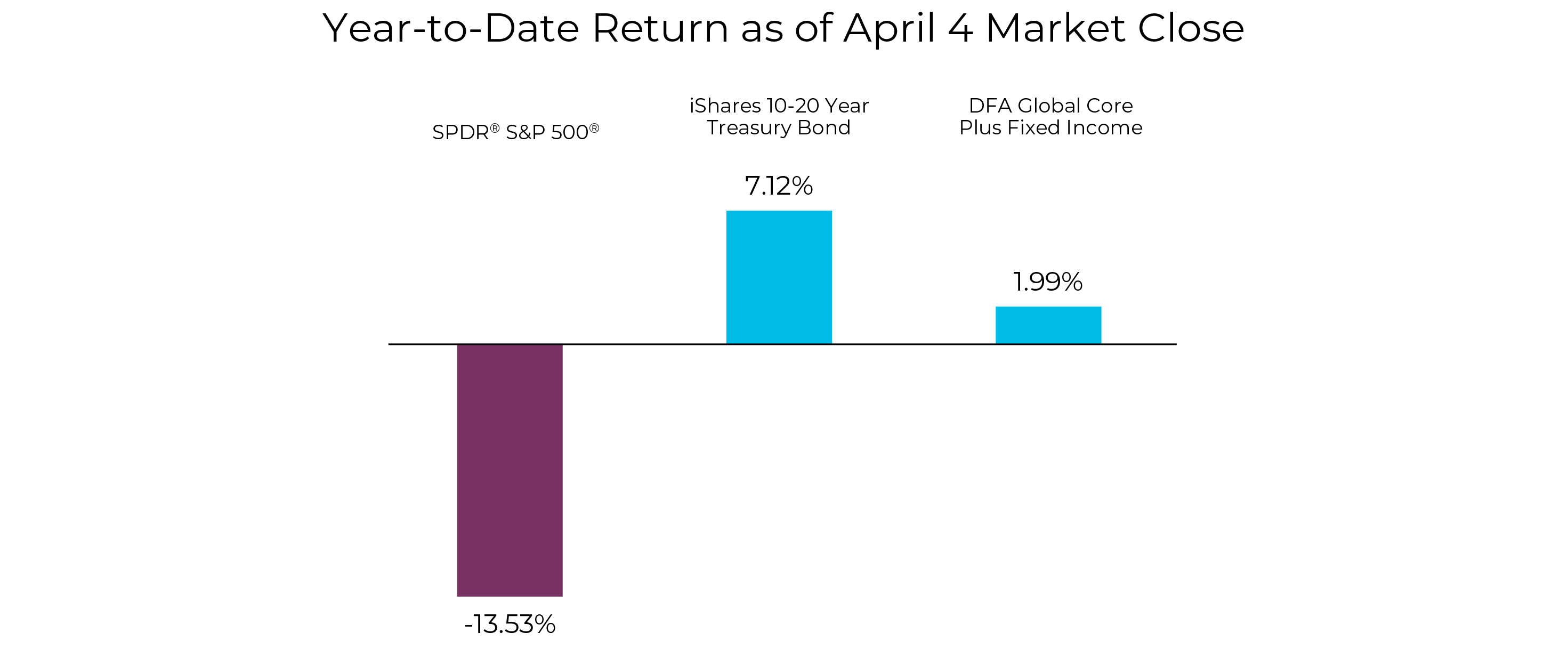

- Long-Term Bonds

While long-term bonds didn’t work in 2022 for various reasons (covered here), these past few days are exactly the kind of time when long-term Treasury Bonds have the greatest impact, much as they did in March 2020. Having bonds go up while stocks decline is exactly what makes our rebalancing strategy so effective and impactful in a down market.

Conclusion

We understand the temptation to “sit it out” and wait on the sidelines. But doing so not only can be highly damaging to your long-term plans, you will more than likely miss the recovery that often happens quickly and well before things look better.

A disciplined rebalancing strategy and looking for meaningful loss-harvesting opportunities are the two best strategies we have for taking advantage of market volatility. Your Forum advisor is here to offer comfort and calm during turbulent times like these.

Here’s an additional perspective if you’re looking for more:

https://awealthofcommonsense.com/2025/04/how-bad-could-this-get/