While 2023 will look like a great calendar year return, it certainly did not feel that way for most of us living through it day by day. 2023 was a difficult year to be an investor, but one that ended with big rewards. As we begin 2024, many people have changed their mindset from assuming a recession is right around the corner to having a more optimistic view of the future.

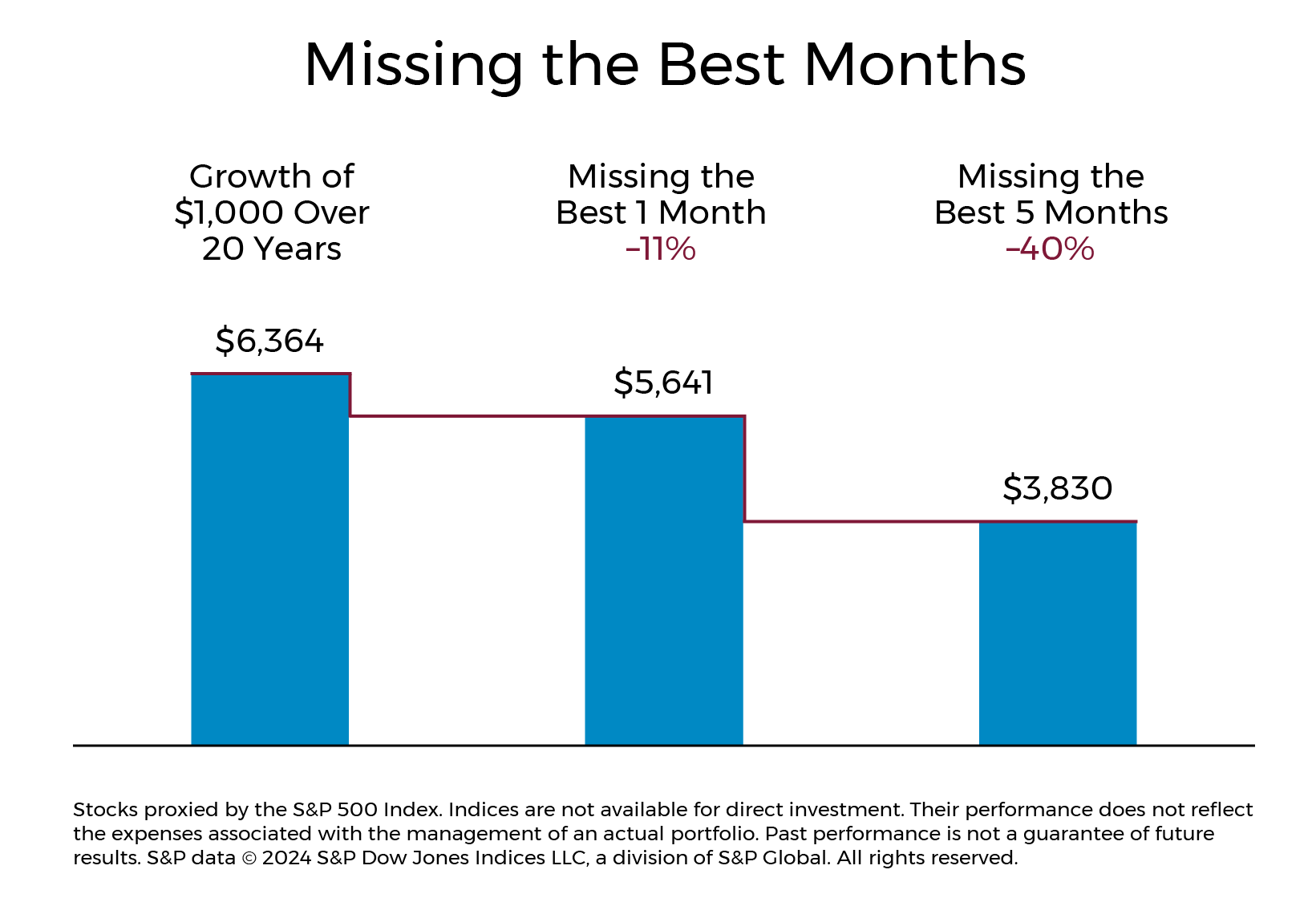

The majority of last year was stress-inducing for investors, but a significant market shift occurred in November, and investors were largely rewarded. In fact, November 2023 was the sixth best-performing month (as proxied by the S&P 500 Index) in the last two decades!

These kinds of outsized rewards make it nearly impossible to know when to invest in or get out of markets. We frequently emphasize the importance of staying disciplined for this reason.

The chart below highlights the impact of missing just a few of the best market returns. Missing either the best days or the best months can materially reduce your long-term wealth.

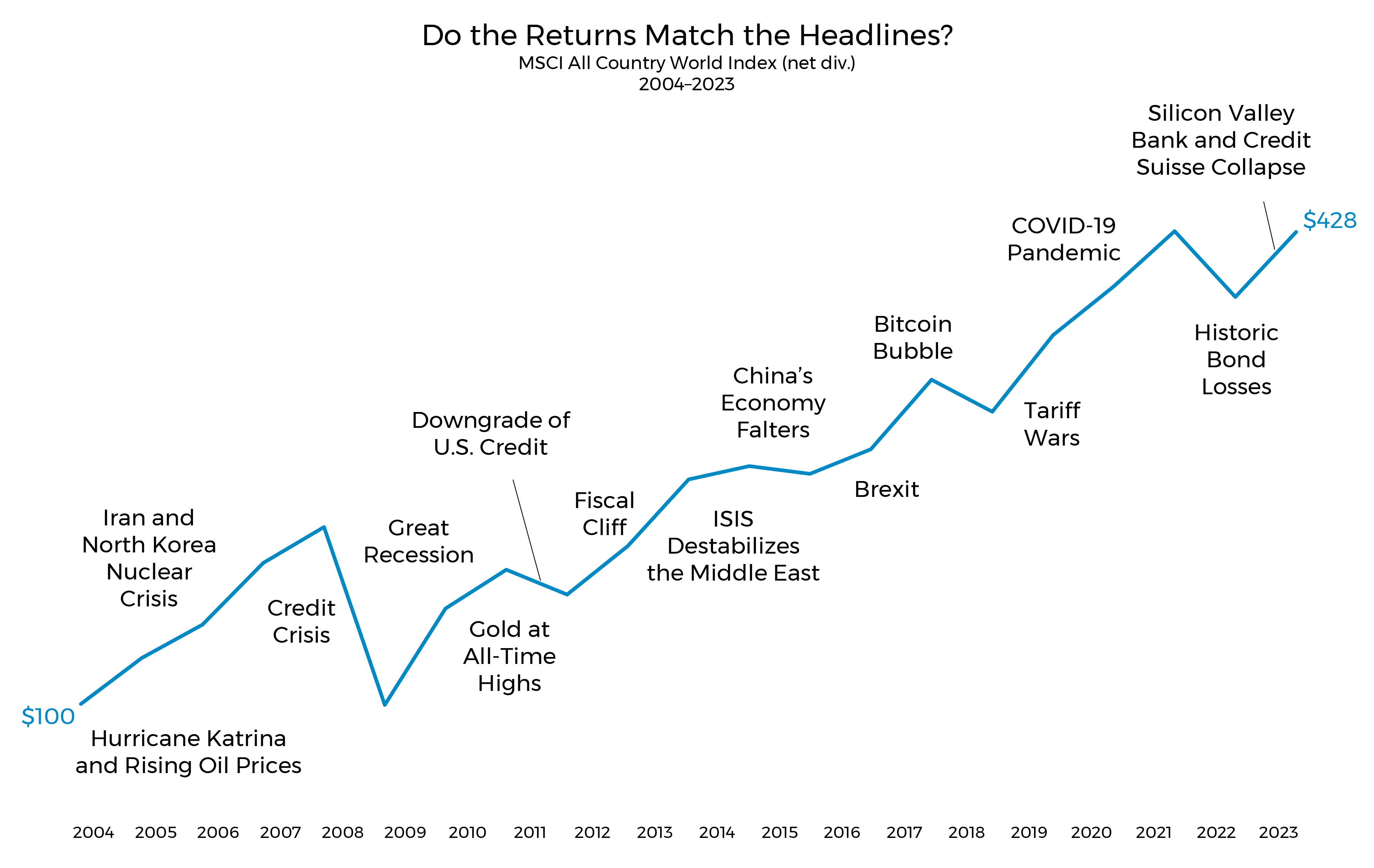

Historically, many great return years were actually very hard to live through because the headlines were filled with pessimism. The chart below shows disheartening news headlines happen every year, yet 15 out of the past 20 years stocks ended up positive for the year.

Often as investors, we find it tempting to think we know whether markets are doing well or not. If our recent experience has been bad, we expect tomorrow to be bad and vice versa. Markets simply do not work like that, and we must guard against the temptation to think that they do.

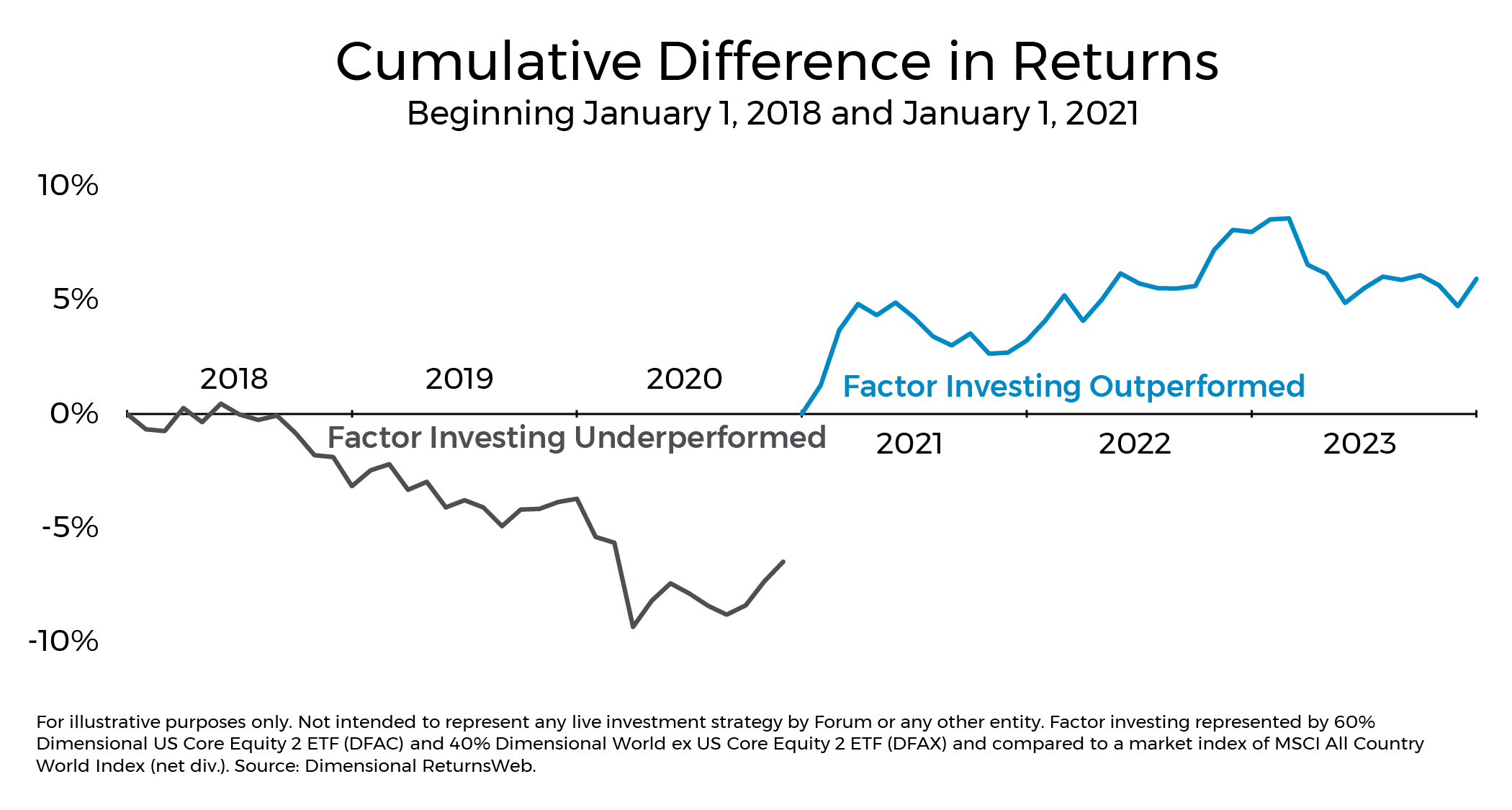

For example, clients who employed a global “factor investing” strategy — the academically based foundation for how Forum’s portfolios are designed — have felt like things have been going poorly for a while. Certainly, from 2018 to 2020, growth stocks did abnormally well relative to value stocks. It can seem like that has been the case for a long time, but in reality, the last few years have actually been better for factor investing globally, almost making up for the prior 3-year period.

Investing is about thinking ahead about the long term and investing accordingly. In a way, it is like a car trip. Recent events only tell us where we turned to get here. They do not tell us how to navigate the next mile because the road ahead is different. Our best bet is to have a good map (long-term returns) and an idea about where we are headed (a financial plan). And, of course, it helps to have good company along the way. We are honored that you will continue to bring us along on your journey into 2024!

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio, nor does diversification protect against market risk. All investment strategies have the potential for profit or loss, including loss of principal. The future performance of any investment or financial planning strategy, including those recommended by Forum, may not be profitable or suitable or prove successful. Individual client results may vary. Past performance is not indicative of future results.

The S&P 500 is an unmanaged weighted index of common stocks. Performance results do not reflect fees, expenses, or sales charges, which would diminish results. Index performance is not indicative of the performance of any investment. Any index or benchmark performance figures are for comparison purposes only and client account holdings will not directly correspond to any such data.